I. This week’s market review

In the past week, domestic and foreign cotton trends opposite, the price spread from negative to positive, domestic cotton prices slightly higher than foreign. I. This week’s market review

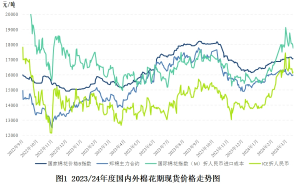

In the past week, domestic and foreign cotton trends opposite, the price spread from negative to positive, domestic cotton prices slightly higher than foreign. The main reason for this phenomenon is that the United States cotton is affected by the strong dollar and sluggish demand in the international textile market, the contracted volume and the shipping volume have declined, and the price has continued to fall. The domestic textile market is lukewarm, and cotton prices are relatively stable. Zhengzhou cotton futures main contract settlement average price of 16,279 yuan/ton, up 52 yuan/ton from the previous week, an increase of 0.3%. The main cotton futures contract in New York settled at an average price of 85.19 cents per pound, down 3.11 cents per pound, or 3.5%, from the previous week. The average price of domestic 32 combed cotton yarn is 23,158 yuan/ton, down 22 yuan/ton from the previous week; Conventional yarn is 180 yuan/ton higher than domestic yarn, up 411 yuan/ton from the previous week. The main reason for this phenomenon is that the United States cotton is affected by the strong dollar and sluggish demand in the international textile market, the contracted volume and the shipping volume have declined, and the price has continued to fall. The domestic textile market is lukewarm, and cotton prices are relatively stable. Zhengzhou cotton futures main contract settlement average price of 16,279 yuan/ton, up 52 yuan/ton from the previous week, an increase of 0.3%. The main cotton futures contract in New York settled at an average price of 85.19 cents per pound, down 3.11 cents per pound, or 3.5%, from the previous week. The average price of domestic 32 combed cotton yarn is 23,158 yuan/ton, down 22 yuan/ton from the previous week; Conventional yarn is 180 yuan/ton higher than domestic yarn, up 411 yuan/ton from the previous week.

2, future market outlook

International cotton prices are weak, and future market factors are intertwined. While employment and average wages continue to grow in the United States, the continued high level of Federal Reserve interest rates has led to high housing costs in the United States, while rising crude oil prices have increased the cost of living, leading to a shrinking demand for textiles and apparel. From the recent situation of more than a month, due to the reduction in interest rate expectations in the United States, the escalation of geopolitical conflicts in the Middle East, funds continue to flow into precious metals and energy sectors, and the trend of agricultural products is weak. At present, the main cotton producing countries in the northern hemisphere have entered the spring sowing stage, and the impact of weather changes on spring sowing will gradually become the focus of market attention, and the possibility of speculation cannot be ruled out.

Macroeconomic recovery, domestic cotton prices or will continue to fluctuate strongly. According to the National Bureau of Statistics, the consumer price of clothing in March rose 0.6% month-on-month and 1.8% year-on-year. The price of raw materials purchased by industrial producers rose 0.3% month-on-month and 0.5% year-on-year, showing signs of recovery in the macro economy. According to the national cotton market monitoring system survey, the intended planting area of domestic cotton in 2024 has decreased year-on-year, and the market speculation weather psychology has become stronger during spring sowing, and it is expected that the possibility of strong fluctuations in domestic cotton prices in the near future is greater.

Post time: Apr-15-2024