Five directions for future capital focus:

1. Artificial Intelligence: Boom or bubble?

2. Disruptive changes in the healthcare industry

3. Automation and robotics

4. Building energy infrastructure

5. Redefining national security

AI: Boom or bust?

Yes, U.S. big tech companies have opened the spigot for AI spending, but these are still early days. We think capital investment in AI could take off in the coming years, driven by rapid improvements in AI models and corporate adoption. Consider: AI could potentially impact all services activity in the economy.

Why are we so optimistic? First, because AI models are improving at a rapid rate. In 2021, large language models (LLMs, a type of AI) could answer less than 10% of competition-level math questions accurately. That share increased to 90% in 2024. The models are also becoming less expensive: The price per token for both OpenAI’s higher-performing GPT-4o mini model and Anthropic’s Claude 3.5 Haiku model are 90%–98% less expensive than their predecessors.

Second, overall corporate capital investment has been relatively muted, running at a 2.5% annual pace. By contrast, at the end of the dot com boom at the turn of the millennium, corporate capex was running at a 10% annual pace (on a five-year rolling basis). In other words, there is plenty of room for corporations across sectors to increase their AI spending as the use cases become more apparent—and persuasive.

Third, we see the potential for AI to “turn labor into software,” as Sequoia Capital has put it. As models improve their ability to reason instead of merely generating pre-trained responses, they will help create opportunities to disrupt the services sector. AI lawyers, AI software engineers and—dare we say it?—AI investment strategists could become commonplace. Public markets and their private partners have established a strong presence in the digital infrastructure of AI. The industrial and utilities companies that provide the physical components and energy needed for AI will also likely continue to benefit. Finally, the companies that most effectively improve their cost structures and increase productivity by incorporating AI tools into their workstreams should outperform.

In private markets, pure-play AI valuations have inflated, but we still see investment opportunities in the startups that can automate tasks and provide cost savings to businesses. Value may also be created in the potential applications that can help harness the technology for consumers. Over 20 major application layer companies (e.g., Salesforce, Meta, Uber) were founded during the cloud and mobile transitions. AI could create a similar ecosystem.

Adoption of AI could falter, of course. Regulation could stifle innovation. Energy sourcing could prove onerous. And the models could run out of the data they use to train. But our analysis—looking past the hype and drawing on the lessons of history—tells us that AI offers significant investment opportunity. We see the potential for a clear bull case for the global economy and equity markets next year and beyond.

Artificial Intelligence: Boom or bubble?

Big tech companies in the United States have opened the door to AI investment, but it’s still early days. We believe that with the rapid progress of AI models and gradual acceptance by enterprises, AI capital investment will experience explosive growth in the next few years. Imagine that AI could profoundly impact every service sector in the economy.

Why are we so optimistic about AI?

1. The performance of AI models is constantly breaking through. Remember that in 2021, large language models (LLMs) could accurately answer less than 10 percent of competition-level math questions, but by 2024, that percentage had soared to 90 percent. What’s more, the cost of using these models is also falling rapidly. Taking OpenAI’s GPT-4o Mini and Anthropic’s Claude 3.5 Haiku as examples, the price per Token is 90-98% cheaper than the previous generation products. Second, overall capital spending by companies is currently growing slowly, at an average annual rate of just 2.5%. By contrast, at the peak of the dotcom bubble, corporate capital spending was growing at 10 per cent a year. This means that as the practical application of AI becomes clearer, there is still a lot of potential for enterprises in various industries to invest in the field of AI.

2. AI could bring about a “labor revolution.” According to a Sequoia Capital survey, AI has the potential to turn “labor into software.” As AI models move from simple pre-trained responses to stronger reasoning capabilities, the service industry will see new opportunities for disruption. In the future, AI lawyers, AI software engineers, and even AI investment strategists are likely to become part of our daily jobs.

The development of AI will not only depend on digital infrastructure; industrial companies and utilities that provide the physical equipment and energy for AI will also benefit. Those who can use AI tools to optimize their cost structure and improve production efficiency will have a competitive advantage.

In the private market, while the valuations of pure AI businesses are already stretched, startups that can automate tasks and help companies save costs are still worth watching. There are also opportunities for potential applications of AI, such as developing practical technologies for consumers. In the past, the transformation of cloud computing and mobile Internet has spawned giants like Salesforce, Meta, and Uber. We believe that AI will create a similar ecosystem.

Of course, there are risks to the adoption of AI, such as regulation that could limit innovation, energy issues that could become a burden, or even AI models that could run out of available training data. But from historical experience and practical analysis, the investment opportunities brought by AI are huge. We believe that in the coming years, AI will not only drive global economic growth, but also inject strong momentum into the stock market.

Healthcare Disruption

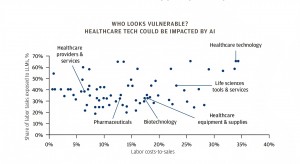

AI may quickly impact the healthcare sector. The chart helps to understand why. The industries that could be most impacted by AI have a high share of labor costs in jobs that could be helped or displaced by LLMs. For example, the healthcare technology industry has labor costs equivalent to around 35% of its sales.

At the same time, economists estimate that 65% of the tasks performed by healthcare technology employees are exposed to AI disruption. For example, companies such as Veeva Systems, Teladoc and GoodRx that provide software solutions across the healthcare value chain could both reduce their labor costs and increase their revenues by incorporating AI into their businesses.

In the pharmaceutical and biotech sectors, AI could also potentially improve the quality and quantity of drugs that progress from early-stage trials to market. Right now, only 7% of new drugs make it to market. Just a 5% increase in that success rate could mean 60 new drugs and USD 70 billion in incremental revenue over a 10-year period. In life science services, companies could use AI to design drug trials more optimally: from compound identification to participant selection.

We also believe GLP-1 drugs will continue to drive revenue growth (glucagon-like peptide drugs control blood sugar and suppress appetite). According to our estimates, we think the total addressable market could grow from 16 million people in the United States and the European Union in 2027 to over 40 million people. Beyond GLP-1s, we are focused on identifying companies in the healthcare sector that can use AI to modernize their business models to drive earnings growth. The clearest examples right now are in robotic surgery and imaging technologies used for diagnostics.

Disruptive changes in the healthcare industry

Artificial intelligence (AI) is rapidly changing the medical industry, and the logic behind this is actually very simple: some jobs with high labor costs can be optimized or even replaced by AI. In the medical technology sector, for example, labor costs account for about 35% of sales, and experts predict that 65% of these jobs could be disrupted by AI.

Companies like Veeva Systems, Teladoc, and GoodRx provide software solutions for the healthcare industry. If AI is introduced, it can not only reduce labor costs, but also increase income. In the pharmaceutical and biotechnology fields, the addition of AI may significantly improve the efficiency and success rate of drug development. Currently, the success rate of new drugs from early trials to market is only 7 percent. If that percentage could be increased by 5%, 60 new drugs could be added over the next 10 years, generating up to $70 billion in additional revenue. In addition, the life sciences service sector can also optimize the drug trial process through AI, from compound screening to trial participants, the selection is more scientific and efficient.

We are also particularly bullish on GLP-1 drugs (glucagon-like peptide drugs), which not only control blood sugar but also suppress appetite. We estimate that the potential market for such drugs will grow from 16 million people in the US and the EU to more than 40 million by 2027.

In addition to GLP-1 drugs, medical companies that can use AI to upgrade their business models are also worth watching. Current examples include robotic surgery and imaging for diagnostics, directions that are rapidly driving profitable growth in the industry.

Automation & Robotics

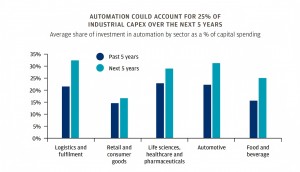

Capital investment in AI will also fast-track the adoption of automation and robotics, impacting industrial and consumer sectors. U.S. industrial companies are set to allocate 25%–30% of their capital spending to automation over the next five years, up from 15% to 20% over the last five years.

This theme isn’t new. Single-purpose robots have existed for over half a century, and robotics returns for investors have been modest so far. But we think momentum is building for broader applications. As access to training data increases and the cost of hardware declines, general-purpose robots may be closer to achieving the ability to reason. Globally, companies have invested over USD 4 billion in funding more than 20 “humanoid” robots.

Eventually, robots (humanoid and otherwise) may become a part of our daily lives. Waymo is already providing more than 100,000 autonomous taxi rides per week.

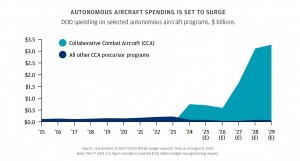

Healthcare and defense are two other areas where robotics will become more prevalent. In October, Intuitive Surgical delivered 110 of its semi-autonomous, AI-enabled Da Vinci 5 robotic surgery systems, trouncing the 70 placements from the previous quarter. Earlier in the year, the U.S. Air Force announced a contract award with Anduril and General Atomics to develop Autonomous Collaborative Combat Aircraft. The Department of Defense expects to spend nearly USD 3 billion per year on the program by 2029.

We see investment opportunities in both public and private markets, in the semiconductor companies that provide the computing power, the software companies that harness that computing power, the industrial companies that capitalize on higher efficiency, and the consumer companies that can deliver a game-changing product.

AUTONOMOUS AIRCRAFT SPENDING IS SET TO SURGE

AUTOMATION COULD ACCOUNT FOR 25% OF INDUSTRIAL CAPEX OVER THE NEXT 5 YEARS

The rise of automation and robotics

Capital investments in artificial intelligence (AI) are accelerating the adoption of automation and robotics, impacting both the industrial and consumer sectors. Over the next five years, U.S. industrial companies are expected to spend 25% to 30% of their capital expenditures on automation, up from 15% to 20% in the past five years.

The theme is not new. Single-purpose robots have been around for more than half a century, but the return on investment has not been outstanding in the past. However, as training data becomes more accessible and hardware costs gradually decline, robot applications are moving into a wider range of fields. General-purpose robots, in particular, seem to be getting closer to achieving the ability to “reason.” Globally, companies have invested more than $4 billion to support more than 20 “humanoid” robot projects.

In the future, whether it is humanoid robots or other forms of robots, it is likely to gradually integrate into our daily life. Waymo, for example, currently offers more than 100,000 autonomous taxi rides a week.

In the medical and defense sectors, the use of robotics is also increasing rapidly. In October, Intuitive Surgical delivered 110 AI-equipped Da Vinci 5 robotic surgical systems, up from 70 in the previous quarter. Earlier this year, the Air Force signed a contract with Anduril and General Atomics to develop an Autonomous Collaborative Combat Aircraft. The Defense Department expects the annual budget for the program to be close to $3 billion through 2029.

We believe that investment opportunities exist not only in the robots themselves, but also in their related upstream and downstream industries. Semiconductor companies that provide computing power, technology companies that develop software to make the most of it, industrial companies that increase efficiency through automation, and companies that can turn robotics into consumer-grade disruptive products are all areas to watch.

Building Power Infrastructure

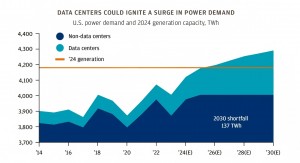

We think capital investment into the power sector is about to ignite for three key reasons: the reindustrialization of U.S. manufacturing, increased use of electrification in clean energy solutions, and surging demand from data centers. Overall, we expect power demand growth in the United States to increase by 5x to 7x over the next 3–5 years.

Data center growth is a global phenomenon. The number of U.S. data centers, accounting for 40% of the global market, is growing ~25% per year. In Q1 2024, the European, Latin American, and Asia-Pacific data center markets grew inventory by 20%, 15%, and 22% year-over-year, respectively. Increased data center power requires more water for cooling and chip fabrication, often in water-stressed areas. Global data centers are expected to grow their water usage by 6% annually. Large semiconductor fabrication facilities use the same amount of water as 300,000 households. We see opportunities for water infrastructure and efficiency solutions in parallel with growing power usage.

More power will likely come from nuclear energy. We note the equity market’s validation of Constellation Energy’s and Microsoft’s agreement to restart the Three Mile Island nuclear power plant to supply energy to the tech giant’s data centers. This should spur further reinvestment in nuclear energy. Indeed, the surge in the Nuclear Renaissance Index (+75% year to date) is based on market speculation that small modular reactors will be successfully deployed in the next few years. While renewable energy sources will continue to grow (the International Energy Agency believes that for every $1 invested in fossil fuels, $2 are invested in clean energy), latency, transmission, and storage costs mean that natural gas will remain a critical energy source.

Investors looking to capitalize on the growing demand for power can focus on broad infrastructure funds, power generation, and utility companies.

THE MARKET HAS VALIDATED NUCLEAR EXPANSION

DATA CENTERS COULD IGNITE A SURGE IN POWER DEMAND

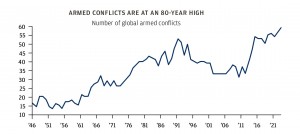

ARMED CONFLICTS ARE AT AN 80-YEAR HIGH

Building power infrastructure

We believe that capital investment in the power sector is poised for rapid growth for three key reasons:

(1) the re-industrialization of U.S. manufacturing;

(2) the widespread use of electrification in clean energy solutions;

(3) the surging demand for electricity in data centers.

Over the next three to five years, electricity demand in the United States is expected to grow five to seven times.

The growth of data centers is a global phenomenon. Currently, the number of data centers in the United States accounts for about 40% of the global market and is growing at about 25 % per year. In the first quarter of 2024, data center inventory in Europe, Latin America and Asia Pacific increased by 20%, 15% and 22%, respectively, year over year. The high demand for power in data centers is also accompanied by greater demand for water, mainly for cooling and chip manufacturing, especially in water-stressed regions. Water use in data centers worldwide is expected to grow by 6 percent annually. A large semiconductor manufacturing plant uses the same amount of water as 300,000 homes. This trend opens up investment opportunities for water infrastructure and water efficiency solutions.

Nuclear power could become an important source of more electricity. The market has embraced Constellation Energy’s partnership with Microsoft, which plans to restart the Three Mile Island nuclear power plant to power Microsoft’s data centers. This cooperation is expected to further promote reinvestment in nuclear energy. In fact, the “Nuclear Renaissance Index” has risen 75 percent this year, largely due to optimistic market expectations for the successful deployment of small modular reactors (SMRS) in the next few years.

While renewables will continue to grow rapidly (according to the International Energy Agency, $2 for every $1 invested in fossil fuels goes into clean energy), natural gas will remain an important energy source because of delays, transmission and storage costs.

For investors looking to take advantage of growing demand for electricity, look to a wide range of infrastructure funds, power production companies and utilities.

Redefining Security

As governments reassess their national security, they will likely deliver higher levels of capital investment. Security covers not just traditional military defense, but cybersecurity, supply of critical natural resources, energy production, transportation, and infrastructure. We think markets do not yet fully appreciate the investment prospects that this secular shift will create.

In the United States, the government seems likely to continue incentivizing domestic production of critical supplies. Shares in a North Carolina–based chipmaker surged 40% on the news that it secured USD 750 million in CHIPs Act funding to build two new semiconductor plants in the United States. Further, we highlight a U.S. government goal to diversify its reliance on concentrated aerospace and defense specialists (which today account for 90% of the U.S. weapons production budget), and expand to established commercial companies and startups with expertise in areas such as AI, machine learning, and 5G technology. The defense market could potentially generate revenues and market share for companies outside the traditional defense space. The Department of Defense budget has halved as a share of GDP from the height of the Cold War. Of the European Union members of NATO, 16 of the 23 are currently on track to surpass the targeted 2% of GDP threshold in 2024. Ten years ago, the average member was only at 1.2% of GDP. Global military spending seems to have room to grow, especially in areas such as network-enabled weapons, which could be human-machine partnerships or fully autonomous.

Europe’s security concerns reflect its reliance on external sources for critical goods and commodities. The European Union imports over 90% of digital products and services, depends on Asia for 75%–90% of wafer fabrication capacity, and relies on China for up to 70% of key raw materials such as nickel, copper, and cobalt. Meanwhile, the BRICS+ economies control 5x the natural gas reserves of the G7, have 3x the active-duty military personnel, and double the oil reserves and uranium production. Last year, Russia boosted its defense budget by 25% to hit a new record.

In all, we believe global spending on security will be comparable to the annual investment in cloud computing and e-commerce during the 2010s. Building out semiconductors, infrastructure, and reliable, affordable power are not only pivotal levers for national security, but also for global economic competition.

We are looking for opportunities in the industrial, utilities, materials, and energy sectors. All but the industrials sector trade at a discount to the broad market. Investors don’t seem to be giving these companies much credit for future earnings growth, which we believe will be nearly double that of the market over the next few years.

In private markets, investors can find interesting prospects in smaller companies focused on innovation in technology-enabled defense systems and cybersecurity.

Redefining national security

Governments are reviewing national security strategies and are likely to invest more in the future, not only in traditional military defense, but also in cybersecurity, the supply of critical resources, energy production, transportation and infrastructure. The hidden investment opportunities behind this have not been fully explored by the market.

In the United States, the government seems to favor local production of key goods through policy incentives. For example, a North Carolina chipmaker recently saw its stock price jump 40% when it received $750 million in Chip Act funding to build two new semiconductor plants. At the same time, the U.S. government is trying to reduce its reliance on a handful of traditional defense giants, which currently account for 90 percent of the defense budget, in favor of commercial companies and start-ups with expertise in technologies such as artificial intelligence, machine learning, and 5G. This means that market share and revenue in the defense sector will no longer be limited to traditional defense companies.

Europe’s security problems are more complex.The EU is heavily dependent on external supplies: more than 90% of its digital goods and services are imported, 75-90% of its wafer production capacity comes from Asia, and up to 70% of key raw materials such as nickel, copper and cobalt are imported from China.

Meanwhile, the BRICS+ have five times as much control over gas reserves as the G7, three times as many active military personnel, and twice as much oil and uranium as the G7. This resource dependence exposes Europe to enormous strategic risks. Still, there is plenty of room for growth in global military spending, especially in high-tech weapons. For example, human-machine cooperative weapon systems and fully autonomous weapon systems are rapidly developing. Last year alone, Russia increased its defense budget by 25 percent to a record high.

Where is the entry point for investment?

The energy, industrials, utilities and materials sectors are becoming the focus of investment. With the exception of industrials, valuations in all sectors are below the market average, and we believe these sectors could grow earnings at twice the rate of the overall market over the next few years. Especially in the field of energy and infrastructure construction, the increase of semiconductor production capacity and the layout of reliable energy supplies are crucial.

In the private market, small, innovative companies are of particular interest. Companies that focus on technology-enabled defense systems and cybersecurity solutions may have significant growth potential in the future.

Redefining security is not just a shift in national strategy; it is an investment that cannot be ignored in the coming years. If this wave of opportunities can be seized, it could lead to stable long-term returns.

Post time: Dec-29-2024