The China General Administration of Customs has set up four special supervision methods for cross-border e-commerce export customs clearance, namely: direct mail export (9610), cross-border e-commerce B2B direct export (9710), cross-border e-commerce export overseas warehouse (9810), and bonded e-commerce export (1210). What are the characteristics of these four modes? How do enterprises choose?

No.1, 9610: Direct mail export

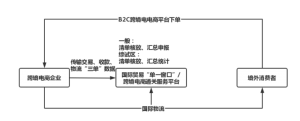

“9610″ customs supervision method, the full name of “cross-border trade e-commerce”, referred to as “e-commerce”, commonly known as “direct mail export” or “spontaneous goods” mode, applicable to domestic individuals or e-commerce enterprises through the e-commerce trading platform to achieve transactions, and adopt the “list verification, summary declaration” mode for customs clearance formalities of e-commerce retail import and export commodities.

Under the “9610″ mode, cross-border e-commerce enterprises or their agents and logistics enterprises transmit the “three order information” (commodity information, logistics information, payment information) to the customs in real time through the “single window” or cross-border e-commerce customs clearance service platform, and the customs adopts the “checklist check and release, summary declaration” method of customs clearance, and issues the tax refund certificate for the enterprise. We will solve the problem of export tax rebates for enterprises. After customs clearance, the goods are shipped out of the country by mail or air.

In order to simplify the declaration, the General Administration of Customs stipulates that the export of cross-border e-commerce comprehensive pilot area does not involve export taxes, export tax rebates, license management and B2C e-commerce goods with a single ticket value of less than 5,000 yuan, using the “list release, summary statistics” method of customs clearance. In terms of export tax refund, the general area has a ticket refund, and the comprehensive test area has no ticket tax exemption; In terms of enterprise income tax, the comprehensive pilot zone approved the collection of enterprise income tax, the taxable income rate is 4%.

The “9610″ model is delivered in small packages and individual packages, allowing cross-border e-commerce enterprises to transport goods from domestic to overseas consumers through third-party logistics providers, with short links, fast timeliness, low cost, more flexible and other characteristics. Compared with 9810, 9710 and other export models, 9610 is most suitable for the export of cross-border e-commerce enterprises in the small package direct mail mode in terms of time.

NO.2, 9710 & 9810

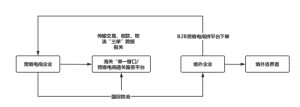

“9710″ customs supervision method, the full name of “cross-border e-commerce business-to-business direct export”, referred to as “cross-border e-commerce B2B direct export”, refers to the domestic enterprises through cross-border e-commerce platform and overseas enterprises to reach a transaction, through cross-border logistics to export goods directly to overseas enterprises, and to the customs transmission of relevant electronic data mode. It is commonly used in cross-border e-commerce export enterprises that use trading methods such as Alibaba International Station.

“9810″ customs supervision method, the full name of “cross-border e-commerce export overseas warehouse”, referred to as “cross-border e-commerce export overseas warehouse”, refers to the domestic enterprises will export goods through cross-border logistics to the overseas warehouse, through the cross-border e-commerce platform to achieve the transaction from the overseas warehouse to the buyer, common in the use of FBA model or overseas warehouse export enterprises.

“9810″ adopts the “order is not placed, goods first”, which can shorten the logistics time, improve the delivery and after-sales efficiency of cross-border e-commerce goods, and reduce the rate of damage and loss of packets; Logistics methods are usually based on sea transport, which effectively saves costs; The significant reduction of logistics time can reduce the disputes caused by too long logistics time and untimely information.

At the customs where the comprehensive test area is located, enterprises can declare the qualified 9710 and 9810 lists, and can apply for simplified declaration in accordance with the 6-digit HS code to reduce the declaration process of cross-border e-commerce retail exports. Cross-border e-commerce B2B export goods can also be transacted in accordance with the “cross-border e-commerce” type. Enterprises can choose the way of transporting goods with stronger timeliness and better combination according to their actual conditions, and enjoy the convenience of priority inspection.

Since July 2020, the “9710″ and “9810″ models have been piloted, and the first batch of pilot work has been carried out in 10 customs offices in Beijing, Tianjin, Nanjing, Hangzhou and Ningbo. In September, the Customs added 12 directly under the administration of Shanghai, Fuzhou, Qingdao, Chongqing, Chengdu, Xi ‘an and other customs to carry out pilot projects.

For example, the Shanghai Customs officially launched the cross-border e-commerce B2B export pilot on September 1, 2020. On the morning of the same day, Yida Cross-border (Shanghai) Logistics Co., Ltd. declared the first “cross-border e-commerce B2B export” goods to Shanghai Customs through the “single window”, and the customs released the goods within 5 minutes after the data was successfully matched. The release of the order marks the official launch of the regulatory pilot in the Shanghai Customs Zone, further improving the cross-border e-commerce business environment and improving the service level of port supervision.

On February 28, 2023, under the support and guidance of Shanghai Municipal Commission of Commerce and Shanghai Customs, with the release of a returned package from Japan of Yida Cross-border (Shanghai) Logistics Co., LTD., Shanghai’s first cross-border e-commerce 9710 export return process has also officially gone through, and Shanghai Port has opened a new journey of large-scale cross-border e-commerce trade “selling the world”!

No.3, 1210: Bonded e-commerce

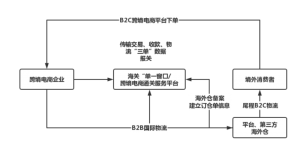

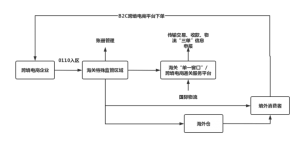

“1210″ customs supervision method, the full name of “bonded cross-border trade e-commerce”, referred to as “bonded e-commerce”, the industry commonly known as “bonded stock mode”, applicable to domestic individuals or e-commerce enterprises in the e-commerce platform approved by the customs to achieve cross-border transactions, and through the customs special supervision areas or bonded supervision places of e-commerce retail inbound and outbound goods.

For example, according to overseas market expectations, domestic enterprises will stock products in advance into bonded warehouses, and then put them on the e-commerce platform for sale and export in batches. This type of batch in, subcontract out, can reduce the operating pressure of production enterprises, especially suitable for the production of enterprises to “sell the world” e-commerce goods.

The “1210″ mode can be further divided into two modes: special regional parcel retail export and special regional export overseas warehouse retail. The difference is that after the latter declares the goods in the special supervision area of the customs to leave the country, the goods are first transported to the overseas warehouse through international logistics, and then transported from the overseas warehouse to the overseas individual consumers. This situation is often seen in merchants using Amazon FBA logistics model or their own overseas warehouse delivery model.

Because 1210 is implemented in special areas, there are some advantages that other regulatory methods cannot compare. Includes:

Return: Compared with the overseas warehouse set up abroad, the 1210 export model will store e-commerce goods in the warehouse of the comprehensive protection zone and receive and ship, which can effectively solve the problem of “out, difficult to return” of e-commerce goods. The goods can be returned to the bonded zone for re-cleaning, maintenance, packaging and resale, while domestic warehousing and labor are relatively cheap. It has more obvious advantages in reducing logistics costs, improving logistics efficiency and avoiding business risks.

Buy global, sell global: the goods purchased overseas by e-commerce can be stored in the bonded area, and then the products can be sent to domestic and foreign customers after customs clearance in the form of packages according to demand, reducing customs clearance trouble, reducing capital occupation, accelerating pallet efficiency, and reducing risks and costs.

Customs declaration compliance: 1210 export mode of e-commerce goods before entering the comprehensive protection zone has completed the export customs declaration statutory inspection and other complete procedures in line with international trade rules, to further protect the compliance of enterprises, enhance the confidence of enterprises to go to sea, is expected to promote the internationally recognized cross-border e-commerce export qualification certification system and traceability system construction.

Tax refund declaration: “1210″ mode goods can be imported and released in batches, and can also be divided into packages, effectively improving the delivery speed of e-commerce enterprises, reducing the risk of overseas inventory, cross-border small package mode exports can also be tax refund, tax refund process is simple, short cycle, high efficiency, shorten the capital operation cycle of enterprises, reduce tax refund time cost, and increase business profits.

However, it should be noted that the 1210 model requires the goods to go out of the bonded area, complete the sale, and settle the foreign exchange payment, that is, the entire goods to complete the sales closed loop, the enterprise can take the information to apply for tax refund.

Post time: May-05-2024